The Complete Procure-to-Pay Process: A Step-by-Step Guide for Manufacturers

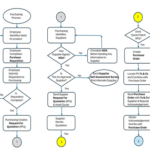

The Procure-to-Pay process—often called “P2P” or “Purchase-to-Pay” is the backbone of Purchasing Workflow control inside every company buying goods or services. A well-designed P2P system prevents financial missteps, eliminates unauthorized spending, and ensures every purchase is traceable from the initial business need all the way through invoice payment and financial reporting.

This long-form guide breaks down every sequential step of the Procure-to-Pay cycle using procurement best practices, internal controls, and supplier-management methodology for real-world use by today’s companies.

Procure-To-Pay Process – P2P

Purchase -> Invoice -> Payment

Procure-to-Pay Process, Step 1: Identification of a Business Need by an Internal Customer

The Procure-to-Pay process begins with a business requirement. An internal employee, be it a department manager, project engineer or maintenance technician, identifies a need for a product, service, or capital expenditure.

This “Identification of Need” is not a procurement event yet—it is a business operations activity. But this ‘need’ must transition into the purchasing workflow so that spending becomes documented, organized, and managed.

Manageing and Controling the Front-End of the Procure-to-Pay Process

Companies that skip this basic early-stage procurement process fall into classic traps:

- Loss of Spend Visibility

- Informal Requests

- Email Based Purchasing

- Rogue Buying

- Misdirected Shipments

- Pricing Inconsistencies

- Lack of Traceability for Audit

- Loss of Spend Visibility

Manageing and Controling the Front-End of the Procure-to-Pay Process: Capturing Internal Customer Requirements Consistently and Accurately

The internal customer (requestor) should have the following information before attempting to fill out a purchase requisition.

- A clear description of the required product or service

- Desired and Need Delivery Dates

- Quantity(s) of Items Needed

- Technical Specification(s) and/or Drawing(s) of Item(s)

- Performance Requirements

- Regulatory, Compliance, Testing, or Certification Requirements

- Budget and Accounting Codes (Chart of Accounts)

This information becomes the foundation for all downstream purchasing activities. Incomplete input at this stage causes delays, supplier errors, incorrect pricing, and inaccurate POs later in the P2P cycle.

Procure-to-Pay Process, Step 2: Completion of a Standardized Purchase Requisition Form

Once the ‘requestor’ has a clear description of the required product or service, the employee documents it on a company approved Purchase Requisition (PR), i.e., the starting point for purchasing documentation quality. A PR:

- Captures ‘all’ required details

- Creates visibility of the purchase

- Initiates budget or a ‘spend’ review

- Triggers supplier sourcing activity

- Forms the audit trail provding the reason for the purchase

Procure-to-Pay Process Requires Essential PR Data Fields

This is not an exhaustive list, but a closed-loop Procure-to-Pay Process should require a standardized purchase requistion with:

- Requisition Priority (Routine or Urgent)

- Item or service description

- Technical Specification(s) and/or attachments

- Quantity(s)

- Unit of Measure

- Required certifications, testing, or quality requirements

- Suggested or recommeded supplier

- Estimated Cost (if known)

- Requested or required delivery date

- Shipping Mode (Standard or Express)

- Department number and Cost Center

- Requester Name and Contact Information

- Financial ‘Spend’ Authorization(s) / Approval(s)

Click here to find a ready-to-use Purchase Requisition form.

https://getyourpurchasingdocuments.com/products/purchase-requisition-form/

Every field exists to eliminate ambiguity, the antithesis of procurement accuracy. If the requestor leaves any of the information fields blank on the PR in most cases will prevent processing.

Why Standardized PRs Reduce Cost and Risk in the Procure-to-Pay Process

Consistency prevents:

- Duplicate purchases or errors when making a purchase

- Incomplete documentationi that will require manual rework by the Buyers and Requesters

- Unapproved or Unauthorized Spend

- Supplier Questions

Procure-to-Pay Process, Step 3: Approval of the Purchase Requisition via Financial Authority

Submitting a PR does not authorize spending, it simply is a request to procurement to make a purchase.

The next step is the ‘approval routing’ for the PR that follows the company’s internal control requirements. Guidance for the authorization to approve a purchase can be found on the Approval Limits in Purchasing table, also referred to as Authorization to Commit Company Funds matrix.

This communicates to all employees and suppliers who has the signature authority or financial control at the company to commit the company’s assets to a purchase.

Click here to find an example of an Approval Limits Purchasing Table.

https://getyourpurchasingdocuments.com/products/approval-limits-template/

The Role of Approval Authority Levels in the Procure-to-Pay Process

Approval matrices define spending thresholds by:

- Job title

- Department

- Category (i.e., whether or not the approver is authorized to approve direct and/or indirect purchases)

- Dollar value (typically stated in a range up to a stated or maximum limit for approvals)

An Agent of the company, whose authority matches or exceeds the estimated purchase amount in both the Category of the purchase and the amount of money, must approve the purchase.

Why the Procure-to-Pay Process PR Approval Is Non-Negotiable

An employee of the company should not make any legal commitment to any financial transaction unless they have ‘agency’ for the Category and ‘level of spending authorization’ for the expenditure – and this designation should be in writing. This allows the employee to act for the company in this kind of relationship with a third party.

The PR approval is the company’s internal contract authorizing Procurement to engage the supply base on behalf of the business.

If this directive and spend authority are not in place, Auditors will assume poor internal controls.

Procure-to-Pay Prcoess, Step 4: Locating and Qualifying a Supplier (Strategic Sourcing Activity)

After an employee, having the Category and financial approval limit for that Category, approves the PR, supplier sourcing begins. This may involve identifying existing suppliers or finding a new long-term source – usually referred to as Strategic Sourcing.

Click here to learn more about Strategic Sourcing at Manufacturing & Supply Chain Services

https://mscsgrp.com/strategic-sourcing/

Supplier Discovery and Initial Screening in the Procure-to-Pay Process

Procurement must determine:

- Does an approved source already exist?

- Can or does this purchase fall under an established contract?

- Is this a purchase where competitive bidding is required?

- Does Purchasing need to find a new source of supply for this purchase?

The Procure-to-Pay Process Revolves Around Verification That the Selected Supplier Is an Approved Source

Before a supplier receives an RFQ or PO, Procurement should confirm that the supplier:

- Is on the Approved Supplier List (ASL)

- Meets the requirements for quality, compliance, and capability

- Meets requirements for quality, compliance, and capability

- Has completed a Non-Disclosure Agreement (NDA) (typcially signed by an officer of that company)

- Meets all safety, insurance, and regulatory obligations

- Is not financially unstable or flagged for ‘risk’

- Has completed and signed a Non-Disclosure Agreement (NDA)

When a supplier is located, which is not a company approved source, the supplier should be qualified under company guidelines before awarding any business.

Supplier Pre-Qualification Inputs

A new source of supply must demonstrate supplier qualification metrics that include:

- Legal business status

- Manufacturing or Service capabilities

- Technical Competency

- Quality certifications (e.g., ISO 9001, AS9100, IATF 16949. etc.)

- Financial stability

- Sustainable operations

- Data security practices

- EHS compliance

Supplier Qualification Tools

There are tools available that outline information helpful in deciding,

- Whether a supplier meets the company’s production, quality, and delivery standards or capabilities, such as Supplier Self-Assessment Survey, and

- The supplier’s operational capabilities in Planning, Production and Logistics, i.e., Supplier Operations Audit.

Click the link below to get a ready-to-use copy of a supplier self-assessment survey.

https://getyourpurchasingdocuments.com/products/supplier-self-assessment-survey/

Click the link below to get a ready-to-use copy of a Supplier Operations Audit form.

https://getyourpurchasingdocuments.com/product/supplier-operations-audit/

Procure-to-Pay Process, Step 5: Issuance of the Request for Quotation (RFQ)

Once Purchasing identifies approved suppliers, the quotation management phase begins that can create (when possible) a competitive bidding environment. A common tool for this process is a Request for Quotation (RFQ).

The RFQ is a controlled document outlining the exact scope of the requested purchase.

What RFQs Should Contain in the Procue-to-Pay Process

A complete RFQ includes:

- Detailed specifications and drawings

- Required testing, quality certifications, or inspections

- Quantity(s) and Unit of Measure

- Delivery Requirements

- Packaging and Labeling requirements

- Incoterms and/or Shipping Requirements

- Expected manufacturing and/or delivery lead time

- Required pricing (e.g., unit price, tooling costs, NREs, etc.)

- Contract terms and conditions (typically a good time to introduce the company’s Ts & Cs)

- Response ‘deadline’

Click here to get a copy of a complete Request for Quotation (RFQ) form.

https://GetYourPurchasingDocuments.com/products/request-for-quotation-rfq/

Why Complete RFQs Eliminate Supplier Errors in the Procure-to-Pay Process

RFQs reduce:

- Pricing discrepancies

- Misinterpretatoins

- Material Substitutions

- Incorrect or Misdirecte d Deliveries

- Unknown supplier requirements or changes that could change to total Cost of the purchase

Clear inputs generate clean outputs—a universal purchasing truth.

Procure-to-Pay Process, Step 6: Supplier Selection and Negotiation of Cost, Terms, and Delivery

Once the Buyer receives the quotations back from the suppliers, it is time to begin evaluating the bids.

When evaluating multiple bids, it is helpful to construct a ‘bid evaluation matrix’ for a bid comparison.

This selection process is typically based upon the ‘value’ added to the buying company (or to ‘end customer’ if the buying company converts and/or resells to another party). To do this it is necessary for Purchasing to determine the Total Cost of Ownership (TCO) and find a correlated elevated level of operational performance and delivery.

Supplier Quotation Analysis

Evaluation criteria can include:

- Price

- Total lead time

- Capabilities (technology is a key factor)

- Quality history

- Past delivery performance

- Available capacity

- Compliance to requireed specifications

- Testing and certification capabilities

- Warranty terms

- Supply Chain risk considerations

- Contract flexibility

Negotiation of Terms

Once a Buyer selects a supplier’s quote, Procurement will move forward to award the business. However, before contacting the supplier, it is helpful to review all aspects of the purchase and decide if it is possible to challenge any aspect of the bid by using procurement negotiation techniques that include:

- Unit pricing – is this the best possible price or can the Buyer leverage this purchase

- Discounts and rebates – what can the supplier offer

- Payment terms – this becomes critical when discussing any payment terms, but more so for large dollar contracts

- Freight responsibilities – Incoterms

- Minimum Order Quantities

- Service level agreements (SLAs)

- Warranty Period(s)

- Penalties for late delivery, non-conforming material, etc. (should be covered by the company’s Ts & Cs)

Selection of the Winning Supplier

Once the supplier and buying company have agreement on the purchase, the Buyer awards the business. By following the processes above, Procurement has justification for the purchase and an audit trail for internal transparency.

Procure-to-Pay Process, Step 7: Purchasing Contracts: The PO Creation Process

With the supplier confirmed, the buyer generates a formal Purchase Order, i.e., the legally binding contractual document for the purchase.

Why Mandatory Purchase Order Fields Support the Procure-to-Pay Process

Typically, and not meant to be an ‘all exhaustive list,’ a company compliant PO includes:

- PO number

- PO Date

- Supplier Name, Address, and Contact Information

- Ship-To and Bill-To Addresses

- Item Desscriptions

- Specification(s), Drawings, and other information as required

- Quantity(s)

- Unit Price and extended total Cost

- Billing account codes

- Tax, freight, and handling

- Payment Terms

- Delivery Date(s)

- Safety Data Sheets (if applicable)

- PO Terms and Conditions (s & Cs)

- Buyer Contact Information

Why POs Are Critical Legal Instruments in the Procure-to-Pay Process

PO creates:

- Contractual obligation

- Commercial record

- Traceable audit trail

- Protection mechanism (PO Ts & Cs) that includes remedies for both parties

No clean procurement system operates without POs and their accompanying Ts & Cs. No clean audit supports purchases without documentation.

You can find a copy of a purchase order form and PO Ts and Cs by following the link below.

https://getyourpurchasingdocuments.com/product/purchase-order-form/

https://getyourpurchasingdocuments.com/product/purchase-order-ts-and-cs/

Procure-to-Pay Process, Step 8: Approval of the Purchase Order

Like PRs, Purchase Orders must follow financial authority approval limits. Even if an agent with the required authority approved of the requisition, sometimes the Buyer may have to alter the PO. If this happens, and the purchase order reflects different pricing, this could change the total costs of the purchase order, and this may require new or re-approval.

Approval Routing for POs

Approval workflow ensures:

- No unauthorized commitments

- Compliance wit spending limits

- Auditable transparency

- Prevention of fraud

- Verification of supplier selection integrity

Procure-to-Pay Process, Step 9: Transmission of the Purchase Order to the Supplier

Once an agent of the company approves a PO, the Buyer sends it to the supplier via:

- Email (considered to be manual in this instance)

- EDI or Supplier Portal

- ERP Integration (that operates in similar fashion to EDI)

- Other ‘programmed’ procurement systems

Why the Company Must Control PO Transmission

Transmitting the approved PO ensures:

- Supplier communication, i.e., the supplier receives official authorization, and the company has record of the receipt

- Supplier begins scheduling of production or service

- Both the supplier and company track the order in the production systems (e.g., MRP / ERP or manually)

Procure-to-Pay Process, Step 10: Supplier Acknowledgement of the Purchase Order

The supplier must return a written acknowledgement confirming agreement to the Purchase Order and its Terms and conditions. Buyers process hundreds of purchases and sometimes a Buyer can overlook the fact that they are missing an acknowledgment for an order from a supplier. However, this is how the two companies form a purchasing contract so it is one of the most important legal buffers (conditions) in the entire P2P lifecycle.

What the Supplier Order Acknowledgement Confirms

The Buyer should review all supplier purchase order acknowledgements to ensure that the supplier’s written acknowledgement confirms exactly what was on the buying company’s purchase order. If it does not then the buying company must immediately contact the supplier and work to resolve any discrepancy or error.

Procure-to-Pay Process, Step 11: Receipt of Goods, Materials, or Services (Goods Received Note)

Once the supplier delivers the product or service, the receiving team performs a formal Goods Received Note [this is like using a manual Receiving Log and/or entering the receipt into the Production system (equivalent to the MRP / ERP system]. This step is essential because it creates the second leg of the three-way match, i.e.,

(PO → receiving → invoice).

What Happens When Goods Are Received

The receiving department verifies:

- The correct products were received by the buying company

- Quantities match the PO(s) and Packing List(s)

- No visible damage to the shipment

- No item or description discrepancies exist between the purchase order and the packing lists

- Documentation accompanies the shipment (typically a packing list and bill of lading)

- Any required product certifications, testing, or regulatory documents accompany the shipment

Goods Received Documentation

Manufacturers use:

- Goods Received Note (GRN)

- Packing lists

- Freight bills (PCS, weights)

- Goods Received Note(s) or Receiving Logs

- Enter receipt transactions into the ERP / MRP production system

In this process, it is critical that the Receiving Clerk ensures correct quantities and Units of Measure when updating inventory records. You can find a copy of a Goods Received Note or a Daily Receiving Log by following the link below.

https://getyourpurchasingdocuments.com/product/goods-received-note/

Managing Non-Conforming Goods

If items fail inspection:

- Non-conformance Reports are issued

- The Receiving Clerk segregates (quarantines) the material making sure that the quantity(s) received do not update the inventory records until the material is accepted.

- Purchasign notifies the supplier and requests action as necessary, e.g., either replacement or credit as needed.

Failure to document this properly creates accounting errors, inventory distortion and could negatively affect production or on-hand inventory.

Procure-to-Pay Process, Step 12: Supplier Invoice Receipt and Matching to the Purchase Order

After shipment, the supplier remits an invoice. Accounts Payable (AP) performs a three-way match with:

- The Purchase Order

- The Goods Receipt Note (and Packing Lists)

- The Supplier Invoice

Why the AP Invoice Matching Prevents Financial Loss

AP confirms:

- Prices match

- Quantity(s) match

- Taxes and freight are as agreed

- The supplier billed correctly

- No duplicate invoices exist (once Accounting records an invoice, and it is not a partial delivery, the Accounts Payable process typically prevents another invoice being recorded for the same purchase order and line without someone intervening in the process).

Click here for a copy of a Sales Invoice for Goods Shipped to a Customer

https://GetYourPurchasingDocuments.com/prodcuts/sales-invoice-with-work-instructions/

Invoice Exception Handling

If mismatches occur:

- AP holds the invoice and contacts Purchasing

- Receiving reverifies the shipping documentation (packing lists, bill of lading)

- Purchasing reviews the PO, packing lists, and material and if an invoice discrepancy is found, the Receiving department reverifies the the packing lists and bill of lading; likewise, if possible the Receiving department will attempt to find the shipment in the warehouse or stockroom and reverify those numbers and product(s) as well.

- Purchasing reviews the PO, packing lists, and material (if possible), and if a discrepancy is found will contact the supplier and have the invoice corrected and resubmitted to the company.

A supplier will not receive payment for any purchases until the Accounting department and Purchasing have resolved any invoice discrepancy.

Procure-to-Pay Process, Step 13: Final Payment to the Supplier

Once Account Payables has a three-way match, Accounting processes the payment. Payment terms usually follow (such as Net 30 or negotiated discounts like 2%/10 Net 30).

Invoice Settlement / Payment Execution

Accounts Payable processes Payments using:

- ACH

- Wire Transfer

- Check

- Virtual Card

- Procurement platform

- ERP automated payment processing

Why the Supplier Payment Process Closes the Procure-to-Pay Process Loop

Payment completes:

- Contractual obligation

- Accounting posts changes to the General Ledger

- Purchasing records the Supplier performance metrics

- Supplier and company spend analysis data is updated

A fully documented P2P cycle gives Procurement and Finance the data they need to optimize sourcing, negotiate better pricing, and strengthen internal controls.

Conclusion: Disciplined Procure-to-Pay Process Protects Cash, Controls and Manages Spend, and Improves Supplier Performance

A world-class Procure-to-Pay process transforms procurement from an administrative burden to a strategic asset. Companies that follow structured P2P workflows enjoy:

- Reduced risk

- Lower total cost

- Recording and reviewing supplier performance for continuous improvement opportunities

- Audit compliance

- Accurate financial reporting

- Improved inventory control

- Faster purchasing cycle times

In an era dominated by supply chain unpredictability, disciplined purchasing is no longer a luxury—it is the operating system that keeps manufacturers alive, efficient, and profitable. If your company struggles with any of these processes, you can find ready-to-use solutions with instructions at GetYourPurchasingDocuments.com (in what is referred to as a Procurement learning system) at https://GetYourPurchasingDocuments.com/

You can also find more information about Procurement and Supply Chain Management by visiting Manufacturing and Supply Chain Services at https://mscsgrp.com/ .

Strong documentation, strong processes, and strong controls give manufacturers the 10– 15% cost savings and supply-chain resilience they keep claiming they want. Help your company today