Revolutionize Your Purchasing and Supply Chain Management Practices Today!

- Explore our Documents and Forms and Get What You Need to Take Your Organization to the Next Level Today!

$199.95

An Activity Analysis is a valuable tool for evaluating the workload and efficiency of purchasing positions, offering actionable insights into the alignment of assigned tasks with available work hours. By analyzing time spent on various procurement activities and comparing the results to the standard 2,080 hours per year, an Activity Analysis can identify whether a purchasing role is overburdened or underutilized.

For overburdened positions the excess workload can lead to critical tasks, such as strategic sourcing supplier negotiations and cost reduction initiatives, being deprioritized or left incomplete. This not only negatively impacts the organization’s ability to achieve cost savings, but also hinders the development of long-term supplier relationships and operational improvements. Conversely, underutilized roles may signal inefficiencies or opportunities to reallocate resources for greater impact.

$199.95

As businesses grow and the volume of transactions affecting company assets increases, it becomes critical to establish an agency doctrine to ensure efficient and consistent decision-making. When the complexity and frequency of transactions surpass the capacity of one or two individuals to effectively manage them, the absence of a clear framework can lead to delays, errors, or mismanagement of resources.

An agency doctrine provides a structured delegation of authority, empowering designated individuals to act on behalf of the company within predefined limits. This system ensures accountability, reduces bottlenecks, and enables faster decision-making. By clearly defining roles, responsibilities, and approval thresholds, the doctrine mitigates risks of unauthorized actions and financial exposure.

Implementing an agency doctrine also strengthens internal controls, improves operational efficiency, and aligns decision-making with organizational goals. Ultimately, it fosters a sustainable approach to managing transactions while safeguarding the company’s assets and supporting strategic growth.

$49.95

Approval Limits in Purchasing is not a bureaucratic hurdle — it’s a critical safeguard approved by executive management that defines who can commit company funds, at what level, and under what circumstances. And when companies expand, complexity multiplies and without structured controls, purchasing decisions can become a breeding ground for overspending, compliance failures, or even fraud. But an Approval Limits in Purchasing matrix reduces risk, ensures financial discipline, and protects company assets from misuse.

At its core, an Approval Limits in Purchasing Table serves as a company’s internal firewall between legitimate business expenditures and potential financial exposure. It ensures that only authorized individuals with designated budget and role-based authority—can approve expenditures or sign contracts on behalf of the organization. Without this clarity, even well-intentioned employees can unintentionally overcommit funds, violate approval policies, or bypass compliance standards.

At GetYourPurchasingDocuments.com, the ready-to-use Approval Limits template was developed to help manufacturers and procurement professionals quickly install structured financial controls aligned with both corporate governance and procurement best practices. It transforms abstract policy into a working system of checks and balances that’s easy to implement, audit, and maintain.

Approval Limits in Purchasing Reduces Financial Risk

Unclear or inconsistent approval structures can create real damage. In growing organizations, departments often operate semi-independently, and managers may authorize purchases without full visibility of the company’s overall budget or contractual obligations. This fragmentation leads to duplicated orders, maverick spending and weakened financial control.

By contrast, a clearly defined Approval Limits in Purchasing Table provides a transparent roadmap of financial authority. It:

- Clarifies who can approve what level of expenditure. No more guessing which manager can sign off on a $5,000 versus $50,000 commitment.

- Defines approval authority by title, department, or region. This helps all companies, individual, multi-site or global companies maintain consistent rules while allowing flexibility for regional budgets.

- Reduces exposure to fraud and unauthorized commitments. When approval boundaries are visible and enforced, it’s harder for bad actors to exploit process gaps.

- Strengthens audit readiness. Every approval is traceable, demonstrating due diligence to internal auditors or external regulators.

- Reinforces procurement policy compliance. Employees follow established procedures instead of informal practices that can lead to cost overruns.

When properly implemented, approval limits don’t just restrict authority; they empower teams to operate confidently, within defined parameters and with higher efficiency. Managers know their limits, finance can forecast budgets accurately, and executives can focus on strategic initiatives instead of chasing down unauthorized purchases.

Approval Limits in Purchasing Strengthen Procurement Governance

An Approval Limits in PPurchasing Table is not a standalone document—it’s the backbone of a company’s Procurement Governance Framework. When linked with other essential tools such as a Purchase Requisition Form, Request for Quotation (RFQ), and Purchase Order Terms & Conditions, the approval structure becomes embedded within the company’s daily operations.

By integrating approval limits into procurement workflows, companies can:

- Automate approval routing through ERP or purchasing systems.

- Prevent unauthorized commitments before they happen.

- Align procurement, finance, and operations under one cohesive rule set.

- Improve financial predictability by keeping spending within approved budgets.

This connection between documents creates a closed-loop system where every purchase—from request to payment—is validated against the organization’s financial authority map. It’s a governance model that not only reduces risk but also builds confidence with auditors, investors, and customers who value financial integrity.

Approval Limits in Purchasing Table and How It Provides Benefits

Executive Management and Procurement team members use it to enforce spending discipline and ensure purchasing aligns with policy.

Finance Teams depend on it to verify that each purchase matches an approved budget.

Executives rely on it to delegate authority efficiently without losing oversight.

Auditors and Compliance Officers reference it to confirm accountability and trace financial decisions.

Each of these roles contributes to the integrity of the organization’s financial ecosystem, and the Approval Limits Table is the common language that connects them all.

What’s Included in the Approval Limits in Purchasing Template

The downloadable Approval Limits in Purchasing Template from GetYourPurchasingDocuments.com includes:

- An editable Approval Limits in Purchasing or also known as an Authorization to Commit Funds Table (Excel/Word)

- Field definitions and completion instructions

- Example role-based approval hierarchies

- A customization guide for enterprise integration

To implement effectively:

- Define threshold limits by management level or department.

- Align these limits with your corporate budget structure.

- Communicate approval authority clearly across all teams.

- Embed the matrix in your Purchase Requisition process to ensure automatic compliance.

You can see an example of a complete Purchase Requisition form by clicking on the link below:

https://getyourpurchasingdocuments.com/product/complete-purchase-requisition-form/

In less than a day, your organization can have a documented, auditable financial approval process that meets the standards of governance, risk management, and compliance.

Why Approval Limits in Purchasing Protect Company Assets

Installing Approval Limits in Purchasing is more than policy—it’s protection. It shields your company’s assets, enforces accountability, and ensures every dollar spent contributes directly to business objectives. In short, it’s how responsible organizations stay in control while empowering their teams to act decisively and transparently.

Download the Approval Limits in Purchasing Template today and give your company the structure it needs to grow safely, efficiently, and profitably.

https://getyourpurchasingdocuments.com/product/approval-limits-in-purchasing/

Learn more about Purchase Order Approval and the associated Approval Limits in Purchasing by visiting,

https://www.inflowinventory.com/blog/why-your-business-needs-a-purchase-approval-process/

$49.95

A Chart of Accounts is a structured listing of all financial accounts used by a business to record transactions in the general ledger.

The COA typically organizes accounts into primary categories correlated to various parts of the business such as Assets, Liabilities, Equity, Revenue and Expenses to categorize and track financial transactions.

The COA helps ensure businesses are conforming to accounting standards, such as Generally Accepted Accounting Principles (GAAP) and the Financial Accounting Standards Board (FASB).

If you are just starting your business and need an illustration of a Chart of Accounts to get started, you can find an example by clinking the link below.

$99.95

Why Every Company Needs a Documented Goods Received Process

A Goods Received Note is more than a form—it is the backbone of procurement accuracy, accounting integrity, and operational control. Whether a company uses a manual Receiving Log or an automated ERP/MRP receiving process, documenting incoming products and services is essential. Without reliable goods receipt documentation, organizations struggle with invoice discrepancies, supplier disputes, production delays, and inaccurate inventory. When the Receiving department follows consistent receiving procedures, every downstream function runs faster, cleaner, and with far fewer operational surprises.

The Role of the Goods Received Note in Modern Procurement

A well-executed Procurement Receiving Procedure starts the moment materials arrive on-site. This is where the Goods Received Note (GRN) becomes the company’s first verified record of truth.

What a Goods Received Note Captures

Accurate goods received documentation captures what was delivered, when it arrived, the quantity received, its condition, and any variances. This snapshot forms the factual basis for evaluating whether the supplier fulfilled the Purchase Order correctly.

Why Procurement Relies on Accurate Receiving Records

Procurement teams depend on receiving data to measure supplier delivery performance. On-time delivery rates, completeness, and quality metrics all hinge on accurate GRNs. Procurement uses this data to:

- Resolve supplier disputes quickly

- Support corrective actions

- Strengthen sourcing decisions

- Prevent paying for undelivered or damaged items

When receiving records are inconsistent or missing, procurement loses visibility—and costs rise fast.

How a Receiving Log Supports Accounting Accuracy

The Receiving Log is indispensable for Accounting because it powers the company’s three-way match between the PO, invoice, and receipt.

Preventing Overbilling and Duplicate Invoices

Invoice errors are unavoidable—but invoice accuracy is easy to achieve when the Receiving department documents every transaction. With a GRN or ERP entry in place, Accounting can verify:

- · Whether invoiced quantities match receipts

- · Whether pricing aligns with the PO

- · Whether duplicate invoices attempt to slip through

The receiving record eliminates ambiguity and protects cash flow.

Strengthening the PO–Invoice–Goods Received Alignment

A disciplined three-way match process ensures the company only pays for what it has actually received. Without the receiving entry, AP is forced to track down Operations or Procurement for manual confirmation—creating delays and increasing the risk of financial mistakes.

ERP and MRP Goods Received Entries for Operational Control

A strong ERP receiving process or MRP material receipts entry keeps operations aligned with reality rather than assumptions.

Real-Time Inventory and Scheduling Benefits

Accurate ERP postings immediately update inventory accuracy, helping planners, schedulers, and production teams know exactly what is on hand. This transparency minimizes emergency expediting, eliminates “missing material” dramas, and supports stable production flow.

Eliminating Production Delays with Clear Receiving Data

Every production delay has a root cause, and inaccurate receiving data is often the silent culprit. Clean receiving entries improve operations efficiency by:

- Ensuring kitting accuracy

- Triggering real-time replenishment

- Reducing false stock-outs

- Supporting reliable production scheduling

Company-Wide Benefits of a Strong Goods Received Procedure

A consistent goods received process strengthens business performance across every department.

Faster Procurement Decisions and Supplier Management

Procurement gains reliable delivery metrics, enabling better forecasting, more accurate supplier scorecards, and improved procurement accuracy during negotiations.

Better Financial Controls and Audit Readiness

Documented receiving department procedures support audit trails and strengthen internal controls. This enhances audit readiness and reduces the risk of compliance issues.

Implementing the Right Goods Received Tools

Companies need tools that eliminate confusion and standardize accuracy.

Using GRNs and Logs from GetYourPurchasingDocuments.com

Ready-to-use Goods Received Note templates, Receiving Log templates, and other procurement templates ensure every detail is captured consistently and professionally.

Integrating Receipts into Your ERP or MRP System

Automating the receipt process with ERP/MRP receiving functionality connects procurement, accounting, and operations in real-time, eliminating manual errors and strengthening overall process flow.

$199.95

Non-Disclosure Agreement: The First Line of Defense in Procurement and Supplier Engagement

A Non-Disclosure Agreement is one of the most fundamental yet frequently delayed documents in procurement and supplier management. It exists for a simple reason: once sensitive information leaves your organization, control is gone unless legal boundaries are already in place. In modern supply chains—where suppliers, vendors, contract manufacturers, and service providers routinely require access to pricing, designs, forecasts, and operational data—the absence of a formal agreement is not an oversight. It is a risk exposure.

A well-structured Non-Disclosure Agreement establishes disclosure restrictions, defines ownership of information, and creates legal enforceability before any meaningful business conversation begins.

Why a Non-Disclosure Agreement Must Come Before Supplier Discussions

Procurement teams routinely share more than they realize. Requests for quotation, engineering drawings, specifications, cost breakdowns, volume forecasts, and customer requirements are all forms of confidential information. Without a signed Non-Disclosure Agreement, there is no contractual obligation preventing a third party from misusing that data.

This is why best-in-class organizations require an NDA before RFQ and certainly an NDA before supplier engagement. Once information is shared, legal remedies become difficult, expensive, and uncertain. Preventive controls always outperform reactive damage control.

This is especially critical when onboarding new suppliers through a formal Supplier Onboarding Process or initiating competitive sourcing events using a standardized Request for Quotation (RFQ).

You can see an example of an RFQ, with a bid summary page, by accessing the link below.

https://getyourpurchasingdocuments.com/product/request-for-quotation-rfq/

A Non-Disclosure Agreement vs. Confidentiality Agreement: No Practical Difference, Big Practical Impact

In practice, a Non-Disclosure Agreement and a confidentiality agreement serve the same function. Both govern how information may be used, disclosed, and protected. The distinction is largely semantic. What matters is clarity.

A professionally drafted non-disclosure agreement template eliminates ambiguity by clearly defining:

- What constitutes confidential information

- How long disclosure restrictions apply

- Permitted and prohibited uses

- Remedies in the event of a breach of confidentiality

Templates that lack these elements create false confidence and weak contract compliance.

Choosing the Right Non-Disclosure Agreement Structure

Unilateral Non-Disclosure Agreement in Procurement

A unilateral non-disclosure agreement is the most common structure used in procurement. Information flows in one direction—from the buyer to the supplier. This is appropriate when sharing proprietary pricing models, internal cost data, forecasts, or intellectual property tied to manufacturing or sourcing strategies.

This structure is ideal for:

- NDA for suppliers during sourcing events

- NDA for vendors providing services or components

- Supplier confidentiality agreement execution during onboarding

Mutual Non-Disclosure Agreement for Strategic Relationships

A mutual non-disclosure agreement is used when both parties expect to exchange sensitive information. This is common in joint development, contract manufacturing, or strategic partnerships. While mutual agreements appear balanced, they still require careful review to ensure disclosure restrictions and liability terms are symmetrical and enforceable.

Both structures should be governed by a standardized NDA form approved by legal and procurement leadership.

Non-Disclosure Agreement as a Procurement Risk Control

A procurement non-disclosure agreement is not merely a legal form; it is a risk mitigation mechanism embedded within the procure-to-pay process. It supports:

- Intellectual property protection

- Safeguarding trade secrets

- Limiting downstream disclosure

- Reducing exposure during supplier transitions

Organizations that formalize NDAs as part of their Supplier Risk Assessment and contracting workflows dramatically reduce the likelihood of data leakage and supplier disputes.

Legal Enforceability and What Makes an NDA Hold Up

Legal enforceability depends on clarity, jurisdiction, and reasonableness. An effective business non-disclosure agreement avoids vague definitions, excessive timeframes, and unrealistic restrictions. Courts are more likely to enforce agreements that clearly balance protection with commercial practicality.

Equally important is documentation discipline. NDAs must be executed, tracked, and referenced in downstream contracts such as Purchase Order Terms & Conditions to maintain continuity and enforceability.

You can find more information about protecting your company in several areas by following the link below.

https://getyourpurchasingdocuments.com/uncategorized/procurement-document-toolkit/

You can also find an example of Purchase Order Terms and Conditions by clicking on the link below.

https://getyourpurchasingdocuments.com/product/purchase-order-ts-and-cs/

Non-Disclosure Agreement, Operational Discipline: When and How to Use One

A Non-Disclosure Agreement should be mandatory when:

- Sharing proprietary information during sourcing

- Engaging new suppliers or service providers

- Issuing RFQs involving pricing or specifications

- Discussing manufacturing processes or tooling

Organizations that rely on informal email disclaimers or verbal assurances are gambling with their most valuable assets.

Embedding NDAs into approval workflows, authority matrices, and supplier onboarding checklists strengthens contract compliance and reinforces accountability across procurement, engineering, and operations.

Not Having a Non-Disclosure Agreement: The Cost of Getting It Wrong

A breach of confidentiality is rarely accidental from a legal standpoint. If no agreement exists, the burden shifts entirely to the company that disclosed the information. Litigation becomes harder, leverage disappears, and competitive advantage erodes quietly.

Some manufacturers mistakenly assume an NDA is optional. Until it isn’t. Without an executed confidentiality agreement, companies are exposed to:

-

- IP theft or replication

- Design leaks

- Supplier sharing your information with your competitor

- Misuse of pricing or commercial terms

- Manipulation of your forecast or cost model data

- Disputes over ownership of jointly developed ideas

In contrast, a properly executed Non-Disclosure Agreement creates a clear standard of conduct and a defensible response when violations occur.

A Non-Disclosure Agreement is a Standard Requirement of a World-Class Purchasing Process

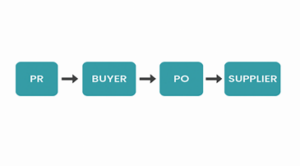

World-class procurement teams don’t treat NDAs as optional paperwork. They bake confidentiality agreements into their sourcing workflow:

- Identify potential supplier

- Execute NDA

- Begin conversation and share controlled documents

- Move into quoting or capability review

This sequence protects the company, speeds up the quoting cycle, and gives suppliers confidence that the information they share is equally protected.

When every supplier follows the same process, conflict drops, compliance increases, and commercial discussions flow cleanly.

Final Thought: Control the Door Before Opening It

A Non-Disclosure Agreement is not a blocker to doing business. It is the doorframe that keeps the structure intact. When procurement teams treat NDAs as a required first step—alongside RFQs, supplier onboarding, and approval limits and a purchase order form—they replace risk with control and assumptions with enforceable obligations.

One final note. Because of the serious nature of this contractual obligation, some companies require an officer from each company to complete the supplier Confidentiality agreement.

Protect your company with Non-Disclosure Agreements today. You can find examples of NDAs by visiting Get Your Purchasing Documents, LLC today https://getyourpurchasingdocuments.com/.

That discipline scales. Chaos does not.

If you would like to learn more about Non-Disclosure Agreements, you can also click on the link below:

$79.95

A Pareto Analysis is an effective tool for identifying cost-saving opportunities in both direct and indirect ‘spend.’ By applying the 80/20 rule, companies can focus on the top 20% of categories or suppliers that drive 80% of total spend.

This targeted approach helps prioritize sourcing efforts, renegotiations, and process improvements where they will have the greatest financial impact. For direct spend, it highlights high-cost materials; for indirect spend, it uncovers inefficiencies and standardization opportunities.

The result is a more strategic allocation of resources, enabling procurement teams to reduce costs and improve performance with data-driven decision-making.

$99.95

Customers Demand Flexibility in Delivery – Procurement Delivers Using Purchase Order Change Forms

A purchase order change form exists for one simple reason: purchasing never goes exactly as planned. Specifications evolve, quantities shift, delivery dates move, and pricing changes – often after a purchase order has already been issued. When organizations lack a structured way to manage those changes, procurement turns into damage control. Forgotten scope changes, missed approvals, and downstream cost impacts quietly erode margins and create disputes that no one budgeted for.

This is where disciplined documentation separates professional procurement teams from expensive improvisation.

Why A Purchase Order Change Form Can Create Risk Without Control

In the real world, most PO changes start informally. A phone call with a supplier. A “quick email” confirming a revised delivery date. A verbal agreement to add services. These shortcuts feel efficient in the moment, but they create serious exposure across the purchase order lifecycle.

Without Purchase Order Change Control, teams lose visibility into what was approved, when it changed, and who authorized the change. Finance receives invoices that don’t match the original PO. Operations receive partial or incorrect deliveries. Suppliers claim approval that no one can prove or disprove. The result is rework, delays, and uncomfortable conversations during audits.

A standardized change order form in procurement brings those loose ends back under control.

The Role of a Purchase Order Change Form in Procurement

A purchase order change form is the formal mechanism used to document, approve, and communicate any modification to an existing purchase order. This includes price adjustments, quantity changes, scope expansions, delivery updates, or contract alignment issues. In practice, it functions as a procurement change management form that protects all parties involved.

Used correctly, it ensures every Purchase Order modification follows a documented path rather than relying on tribal knowledge or inbox archaeology.

On GetYourPurchasingDocuments.com, this process aligns naturally with other standardized procurement forms such as the Purchase Requisition, Approval Limits, and Purchase Order templates—creating continuity instead of fragmentation.

You can find examples of a Purchase Requisition Form, Approval Limits, and a Purchase Order form using the links below.

3 STEPS TO A COMPLETE PURCHASE REQUISITION FORM

REDUCE RISK USING APPROVAL LIMITS IN PURCHASING

A PURCHASE ORDER FORM REDUCES RISK AND COST

Change Order vs Amendment: Why A Purchase Order Change Form Matters

One common point of confusion is a ‘change order’ vs amendment. While both alter an agreement, a change order typically applies to operational or commercial adjustments tied to an active PO, while amendments often relate to broader contract terms. A Purchase order amendment form may address legal language, whereas a PO change form focuses on execution details that impact cost, delivery, or scope.

Understanding that difference helps teams apply the right document at the right moment—without muddying legal and operational boundaries.

How the Change Order Process Works in Procurement

A disciplined change order process procurement follows a predictable sequence:

First, a PO Change request form is initiated when a change is identified. That request captures what is changing, why it’s necessary, and the financial or operational impact.

Next, the request moves through a defined Change Order approval workflow aligned to approval limits and financial authority. This step eliminates guesswork and prevents unauthorized commitments.

Once approved, the change is formally issued using a PO revision document template, ensuring version clarity and consistency. Finally, a supplier notification change order is sent so the supplier is working from the same approved baseline as internal teams.

This closed-loop process creates an audit trail for PO changes that stands up to internal reviews and external audits alike.

Solving the Most Common Procurement Pain Points Using a Purchase Order Change Form

The benefits of PO change forms are not theoretical – they address daily frustrations procurement teams face.

Forgotten scope changes disappear because every adjustment is logged. Missed approvals are eliminated by routing changes through documented workflows. Downstream cost impacts are identified early instead of surfacing as invoice surprises. Finance gains confidence in three-way matching, and operations avoid delivery confusion caused by outdated PO versions.

Just as importantly, version control purchase orders become manageable. Teams know which PO current, what revisions exist, and why each change was made. That clarity alone saves hours of backtracking.

Compliance, Consistency, and Audit Readiness Using Purchase Order Change Forms

From a governance standpoint, a purchase order change form supports ‘procurement documentation compliance’ by enforcing standardized behavior. Auditors don’t want explanations, they want evidence. A documented change order’s process shows that purchasing decisions are deliberate, approved, and traceable.

When combined with standardized procurement forms from GetYourPurchasingDocuments.com, companies create a repeatable system instead of reinventing controls for every exception.

How to Update a Purchase Order the Right Way

For teams wondering how to update a purchase order without creating confusion, the answer is consistency. Do not overwrite the original PO. Do not rely on email chains. Use a formal change document that references the original order, captures the revision, and preserves history.

This approach aligns seamlessly with broader procurement best practices and reduces supplier disputes by keeping everyone aligned on what is current and approved.

Turning Process into Protection By Using a Purchase Order Change Form

At MSCSgrp.com, procurement change management is treated as a risk-reduction strategy, not administrative overhead. A purchase order change form is a simple document, but it solves complex problems—financial missteps, compliance gaps, and supplier misunderstandings.

If your organization already uses structured Purchase Orders, Approval Limits, and Receiving controls, this form is the missing link that keeps everything synchronized.

Download the ready-to-use Purchase Order Change Form from GetYourPurchasingDocuments.com to immediately standardize how your team handles PO revisions, protect margins, and eliminate undocumented changes before they become expensive lessons.

Process beats memory. Documentation beats debate. And ‘controlled change’ beats chaos—every time.

$199.95

A Purchase Order Form is one of the most critical documents for control that a business can use when contracting for products and services. While it is often viewed as routine paperwork, a properly executed purchasing document is one of those cornerstone tools for financial discipline, operational clarity, and supplier accountability. Companies that fail to use a formal purchase order consistently expose themselves to unnecessary cost, risk, and internal confusion.

At its simplest level, using submitted purchasing requisitions, a purchase order documents what is being purchased, from whom, at what price, and under what terms. Once accepted, it becomes a binding supplier agreement that protects both parties by clearly defining expectations before work begins or goods are shipped. This clarity is essential for companies that want predictable outcomes rather than costly surprises. For more informaiton on Purchasing Requisitions, please visit Purchasing Requisitions System: The Digital ‘EZ Requisition Program’ – Home

The Costs and Risks Increase Without A Formal Purchase Order Form

Organizations that rely on emails, verbal approvals, or loosely written quotes instead of a purchase order often believe they are saving time. They are deferring problems. Without standardized procurement documentation, there is no single, authoritative record of the transaction. This leads to disputes over pricing, scope, delivery, and payment terms—issues that consume far more time and money than proper documentation ever would.

A formal purchase order form eliminates ambiguity. It ensures that suppliers understand exactly what they are expected to deliver and provides internal teams with a clear reference point throughout the transaction lifecycle.

A Purchase Order Form Strengthens Financial and Spend Controls

One of the most important functions of a formal purchase order is enforcing purchasing controls. By requiring approvals before a commitment is issued, the organization ensures that spending aligns with policy, budget, and authority limits. This discipline prevents unauthorized purchases and protects the company from accidental or inappropriate commitments.

A structured purchase order form also supports clear spending authorization, ensuring that only designated individuals can approve purchases at defined dollar thresholds. This safeguard is critical not only for audit readiness but also for maintaining trust between procurement, finance, and leadership teams.

Supporting the End-to-End Procurement Process Using a Purchase Order Form

A purchase order anchors the entire procurement process. Procurement teams use it to formalize sourcing decisions, operations teams rely on it to plan and receive deliveries, and accounting uses it to validate invoices. Without this shared reference, departments operate in silos, increasing the risk of errors and delays.

When paired with receiving documentation, these purchasing documents enable a clean three-way match between the purchase order, goods receipt, and supplier invoice. This process is one of the most effective ways to prevent overbilling, duplicate payments, and invoice disputes. You can learn more about a Goods Receipt Note here GOODS RECEIVED NOTE AND RECEIVING LOG PROCESS and a Sales Invoice here Sales Invoice with Work Instructions

Improving Supplier Performance and Accountability with A Purchase Order form

Clear expectations drive better supplier behavior. A procurement template communicates requirements in writing, reducing misunderstandings and setting measurable standards for delivery, pricing, and quality. When issues arise, the purchase order form provides objective documentation to resolve them quickly and professionally.

Suppliers also benefit from this clarity. A standardized purchase order template removes guesswork and ensures that suppliers receive consistent, complete information with every order. This consistency improves turnaround time and strengthens long-term relationships.

A Purchase Order Form Depicts Audit Readiness and Risk Reduction

From an audit and compliance perspective, the purchase order is indispensable. It creates a permanent record of why a purchase was made, who approved it, and under what terms. This documentation protects the company during audits, internal reviews, or disputes by demonstrating that purchasing decisions follow established controls.

Companies that consistently use these formal purchasing documents are better positioned to identify spending trends, enforce policy compliance, and reduce financial missteps across the organization.

Why Use the Purchase Order Form from GetYourPurchasingDocuments.com

The purchase order form available on GetYourPurchasingDocuments.com is built around real-world procurement best practices, not a generic boilerplate. It captures all critical commercial, operational, and financial details required to support controlled purchasing while remaining practical for daily use.

This ready-to-use document helps organizations immediately improve structure, accuracy, and accountability without lengthy design or customization efforts. It is suitable for manufacturers, service providers, and growing businesses that want professional grade purchasing discipline.

The Bottom Line

A purchase order form is not optional paperwork—it is a control mechanism that protects cash flow, enforces accountability, and aligns internal teams with suppliers. Organizations that implement a standardized purchase order form reduce risk, improve efficiency, and gain visibility into their spending. Those that do not eventually pay for the lack of structure through errors, disputes, and lost margin.

In procurement, discipline always costs less than disorder—and the purchase order form is where that discipline begins.

If you do not have a purchase order form and need an illustration of one, you can download a copy using the link below. This Excel form comes with three Tabs on the form, i.e., a Tab with a blank form, a Tab Identifying each field on the form and a Tab defining the information to be entered in each field.

$399.95

Set the Standard with Suppliers Using Purchase Order Terms and Conditions

When it comes to procurement, consistency comes in the form of ‘control.’ Every company is different so the Purchase Order Terms & Conditions Form from Get Your Purchasing Documents provides a great starting point to build a legal backbone every manufacturing and supply-chain team needs to protect their company from supplier disputes, missed deliveries, and hidden liabilities.

This editable starter form helps you develop protection so that your purchase orders become enforceable contracts, not just order confirmations. Each clause is crafted from the standpoint to reflect industry best practices in manufacturing procurement, giving you clarity, compliance, and confidence in your transactions.

Why Every Company Needs This Form

Procurement isn’t just about placing orders; it’s about managing risk. Without standardized terms and conditions, your business may face:

- Conflicting supplier terms that override your policies

- Unclear definitions of delivery, inspection, or payment expectations

- Costly disputes over defective or delayed goods

- Legal exposure in global supply-chain operations

Our Purchase Order Terms & Conditions Form puts you on the path of eliminating that uncertainty by codifying your expectations—so every vendor, regardless of region or contract size, operates under the same enforceable framework.

—

Key Features and Benefits

✅ Adapt, Review, Ready to Use

The form is provided in an editable format so that you can adapt the terms and conditions to your needs. You don’t have to start from scratch, but you should request a legal review. You can download and enter your company and supplier information to get started.

✅ Built for Manufacturing Procurement

The clauses reflect the realities of industrial purchasing—from raw materials to contract manufacturing—with clear definitions for goods, services, and deliverables.

✅ Reduces Risk and Disputes

Protect your company from non-conforming goods, late deliveries, and warranty issues. Clauses include coverage for inspection rights, governing law, liability, and risk of loss.

✅ Creates Consistency Across All Spend

Standardized language keeps every buyer and every PO aligned. Whether you’re issuing $5,000 or $5 million in spend, the rules stay consistent.

✅ Supplier Clarity = Fewer Delays

Suppliers understand exactly what’s expected, reducing misinterpretations and negotiation friction.

✅ Integrates with Your Procurement Tools

Add this form to your ERP system, procurement workflow, or supplier onboarding package for smooth automation and compliance tracking.

What’s Included

Your purchase includes:

- Editable Form – Professionally formatted Word document for easy customization

- Procurement-Driven Clauses – Covering definitions, acceptance, payment, inspection, warranties, and dispute resolution

- Legal Best-Practice Language – Standardized across goods, services, and hybrid procurements

- Version Control Ready – Update and reissue as your corporate policies evolve

Who Should Use This Document

- Procurement Managers and Category Leaders

- Supply-Chain and Operations Directors

- Contract Manufacturing and OEM Partners

- Consultants and Procurement Service Providers

- Finance and Compliance Teams

If you manage suppliers, sign off on purchases, or lead sourcing projects, this document belongs in your toolkit.

How It Helps Your Organization

| Challenge | Solution with Our Form |

| Suppliers send back conflicting terms | Your PO T&C can override all alternate conditions |

| Vague delivery expectations | Clear definitions of delivery, acceptance, and rejection rights |

| Disputes on non-conforming goods | Explicit inspection, warranty, and return clauses |

| Global supplier risk | Standardized governing-law and liability language |

| Manual legal review delays | Pre-approved template ready for consistent use |

Perfect for Global and Domestic Procurement

Whether sourcing components globally from Malaysia or buying raw materials locally, this form helps to ensure you’re contractually protected.

Pair it with several other forms, i.e., a Non-Disclosure Agreement, Purchase Requisition Form, RFQ Template, and Supplier Self-Assessment Survey, from Get Your Purchasing Documents and work to complete your end-to-end procurement process.

Download and Deploy Today

The Purchase Order Terms & Conditions Form gives your company a professional, legally robust foundation for every purchase order. Safeguard your operations, standardize your processes, and maintain control across your supplier base.

Get started today—download your ready-to-use PO Terms & Conditions Form and protect your company’s bottom line before your next purchase order is issued.

$49.95

Purchase Price Variance (PPV): Why Your Procurement Team Should Track It Relentlessly

Purchase Price Variance (PPV) is one of the most important financial and operational signals inside a disciplined procurement organization. At its core, PPV measures the difference between what a company expected to pay for a material or service and what it actually paid. That delta—positive or negative—reveals how well procurement is controlling cost, executing sourcing strategies, and enforcing purchasing discipline.

In mature organizations, PPV is not treated as a theoretical accounting metric. It is a practical control mechanism used daily to expose pricing drift, supplier behavior, internal compliance gaps, and forecast errors that quietly erode margin.

Purchase Price Variance (PPV) in Procurement Operations

PPV in procurement exists at the intersection of sourcing, finance, and operations. While finance may report the number, procurement owns the behavior that creates it. Every sourcing decision, contract term, price increase approval, or spot buy feeds directly into procurement purchase price variance results.

A strong procurement purchase price variance process depends on standardized documentation. Approved suppliers, controlled purchase orders, and locked pricing terms ensure that actual costs align with negotiated expectations. When companies bypass these controls – buying outside contract, skipping approvals, or allowing uncontrolled changes – PPV becomes volatile and unpredictable.

Spend discipline is supported by using a complete Purchase Order Form and Approval limits in Purchasing. Below are links to examples of these forms.

https://getyourpurchasingdocuments.com/product/purchase-order-form/

https://getyourpurchasingdocuments.com/product/approval-limits-template/

Purchase Price Variance (PPV) Calculation and Standard Cost vs Actual Cost

At a basic level, PPV calculation compares standard cost vs actual cost. The standard cost is typically derived from contracts, price lists, or standard cost rolls maintained in the ERP. The actual cost is what appears on the supplier invoice and is matched during receiving and invoicing.

When actual prices exceed standard cost, PPV turns unfavorable. When procurement secures pricing below standard, PPV is favorable. While the math is simple, the causes are not.

Common drivers include:

• Supplier price increases not formally approved

• Poor contract enforcement

• Incorrect standard cost maintenance

• Emergency or spot purchases

• Volume fluctuations affecting price tiers

This is where purchase price variance accounting becomes critical. Without accurate master data, PPV tells a distorted story – sometimes blaming procurement for accounting errors or outdated standards.

Other important operational pieces to this plan to reinforce accurate cost capture include the Goods Received Note / Receiving Log process and the Three-Way Match when paying invoices. You can find an example of the Goods Received Note / Receiving Log below.

https://getyourpurchasingdocuments.com/product/goods-received-note/

Purchase Price Variance (PPV) Analysis as a Cost Control Tool

Purchase price variance analysis is where PPV shifts from reporting to action. High-performing procurement teams don’t just report PPV—they dissect it. They segment variance by supplier, commodity, buyer, plant, and ‘time period’ to identify patterns that demand correction.

This analysis often reveals deeper cost variance procurement issues such as:

• Non-compliant buying behavior

• Weak supplier negotiations

• Inconsistent volume commitments

• Poor demand planning

For manufacturers, material price variance frequently dominates PPV results. Even small per-unit deviations on high-volume materials compound into a six- or seven-figure exposure over time.

Internal link prompt: Reference your Supplier Performance Evaluation Scorecard to connect PPV trends with supplier accountability.

Purchase Price Variance (PPV) Reporting and Executive Visibility

Effective PPV reporting is concise, consistent, and tied to accountability. Executives do not want spreadsheets full of unexplained numbers. They want to know why PPV moved, who owns it, and what is being done.

Well-designed PPV reports typically include:

• Monthly and YTD PPV trends

• Breakdown by supplier and category

• Favorable vs unfavorable drivers

• Linkage to sourcing actions

When procurement owns the narrative, PPV becomes a credibility builder rather than a defensive exercise. It demonstrates that procurement is actively managing cost, not passively processing orders.

Internal link prompt: Cross-link to Procure-to-Pay Process documentation on MSCSgrp.com to show where PPV fits operationally.

Why Purchase Price Variance (PPV) Is a Procurement Discipline Indicator

Ultimately, Purchase Price Variance (PPV) is not just a financial metric—it is a reflection of procurement maturity. Organizations with clean PPV data typically have strong purchasing controls, standardized processes, and supplier governance. Organizations with erratic PPV often suffer from uncontrolled buying, weak approvals, and undocumented price changes.

When supported by standardized procurement forms, enforced approval workflows, and disciplined supplier management, PPV becomes a powerful lever for protecting margin and improving forecast accuracy.

Protecting company margins begins with using standardized forms such as a Purchase Requisition Form, Request for Quotation template, and a Purchase Order Form to reinforce systemized control. You can find examples of these forms by following the links below.

https://getyourpurchasingdocuments.com/product/complete-purchase-requisition-form/

https://getyourpurchasingdocuments.com/product/request-for-quotation-rfq/

https://getyourpurchasingdocuments.com/product/purchase-order-form/

$199.95

Why Every Business Needs a Purchase Requisition Form to Eliminate Errors and Streamline Procurement

Purchasing should not feel like a scavenger hunt. Yet in many organizations without a complete Purchase Requisition Form, especially fast-moving manufacturing environments, buyers and approvers are constantly piecing together incomplete requests, chasing down missing details, and interpreting vague emails like they’re reading ancient tablets. This chaos drains time, increases risk, and raises the odds of costly mistakes.

A properly structured Purchase Requisition form (PR), like the ready-to-use version on GetYourPurchasingDocuments.com, https://getyourpurchasingdocuments.com/product/purchase-requisition-form/ restores order by standardizing what information the organization must gather before a purchase moves forward. It’s the single simplest step a company can take to tighten controls, speed up approvals, and dramatically reduce purchasing errors.

A Complete Purchase Requisition form Eliminates Guesswork and Reduces Costly Mistakes

Errors in procurement almost always come from missing or unclear information—wrong part numbers, incorrect quantities, incorrect supplier assumptions, outdated pricing, or missing technical requirements. A complete Purchase Requisition template (forces clarity upfront by requiring all relevant data in one place:

Procurement Workflow

- Item descriptions

- Part numbers and revisions

- Quantities, units of measure, and delivery requirements

- Supplier recommendations

- Required attachments (quotes, drawings, SOWs, certifications)

- Account numbers and cost centers

- Requester information and approval routing

When these details are collected at the beginning by using standardized purchasing forms, buyers can execute quickly and accurately. When they’re missing, procurement becomes a detective agency. A standardized PR removes ambiguity and prevents the silent killers of productivity—rework, delays, and unnecessary back-and-forth.

A Purchase Requisition form Creates a Streamlined Procurement Workflow Speeding Up the Purchasing Process

There’s a myth that adding structure slows things down. A good PR speeds everything up because it eliminates the “stop-and-start” delays that happen when buyers are forced to chase missing data. With a complete requisition:

- Approvers know exactly what they’re signing off on.

- Buyers can convert the PR into an RFQ or Purchase Order without rewriting information.

- Finance gains accurate documentation for accruals, budgeting, and audits.

- Suppliers receive clean, unambiguous orders—reducing questions and shipment errors.

The PR acts like an upstream Procurement Documents filter ensuring every downstream step moves smoothly. When implemented correctly, users spend less time on the process because they’re not circle-backing to fix preventable mistakes.

A Purchase Requisiton Forms Create Traceability, Accountability, and Policy Compliance

In any company with spend visibility goals, compliance requirements, or audit expectations, a Purchase Requisition is not optional—it’s the backbone. It creates a documented record of who requested what, who approved it, and why the expenditure was necessary.

This protects your organization from:

- Unauthorized commitments

- Budget overages

- Rogue spending

- Supplier favoritism

- Audit findings

Purchasing best practices include a well-designed Purchase Requisition Form because it includes clear approval signatures or digital signoffs aligned with an Approval Limits in Purchasing table (https://getyourpurchasingdocuments.com/product/approval-limits-template/) That ensures the ‘spend’ or approval authority is followed, and every purchase traces back to a valid need.

A Purchase Requisition form Teaches Users What “Good” Looks Like

Most employees aren’t procurement experts, and they shouldn’t have to be. Your document solves this by embedding field definitions, instructions, and examples directly into the template. This reduces training time and helps new buyers, engineers, and office staff submit clean requisitions from day one.

It’s not just a form—it’s a process guide that makes the whole company better at purchasing.

Why A Purchase Requisition Form Matters

Many companies think they have a “PR process” because they use emails or spreadsheets. That’s not a process—that’s improvisation.

Your ready-made Purchase Requisition provides:

- A consistent structure

- A repeatable workflow

- Full transparency

- Faster cycle times

- Fewer errors

- Stronger internal controls

It takes the guesswork out of purchasing and replaces it with discipline, clarity, and accuracy—the foundation of world-class procurement. Download a copy of the Purchasing Requisition today https://getyourpurchasingdocuments.com/product/purchase-requisition-form/.

Learn more about Purchase Requsitions and the Procurement Process by visiting Manufacturing and Supply Chain Services at

Purchasing Requisitions System: The Digital ‘EZ Requisition Program’ – Home

$99.95

A PURCHASE REQUISITION LOG: KEY TO ORGANIZING AND CONTROLLING PURCHASING REQUESTS

A purchase requisition log is one of the most overlooked yet powerful control tools in a company’s procurement environment. While many organizations rely on individual purchase requisition forms to initiate requests, the log is what transforms those individual documents into a system of records. It provides visibility, accountability, and governance over how internal requests are created, reviewed, approved, and ultimately converted into financial commitments.

How a Purchase Requisition Log Works

Organization

At its most basic level, a purchase requisition log is a centralized register that records every purchase request submitted within the organization. Each entry typically references the originating Purchase Requisition Form, the requester, department, estimated value, approval status, and downstream actions. This structure ensures that requests are not treated as isolated events but as part of a controlled and traceable procurement process.

Control

One of the primary benefits of maintaining a purchase requisition log is effective ‘spend control.’ Without a log, requisitions can be approved in silos, creating blind spots where multiple departments unknowingly request similar items or exceed budget thresholds over time. A centralized log allows procurement and finance teams to monitor aggregate demand and intervene before spending drifts outside acceptable boundaries. This visibility reinforces consistent purchasing controls across departments and locations.

You can learn more about the financial benefits uncovered when controlling the Maintenance, Repair, and Operations costs by following the link below:

MRO Items: Organization, Control & Spend Optimization – Home

Tracking

The log also plays a critical role in purchase requisition tracking. From initial submission through approval and fulfillment, each request can be monitored for status, delays, or escalation needs. This tracking capability helps organizations identify bottlenecks in the approval workflow, such as recurring delays at certain authorization levels or incomplete submissions that stall progress. Over time, these insights allow companies to refine approval structures and improve cycle times without sacrificing control.

A Purchase Requisition Log Assists With Control of Spend

From a governance perspective, the purchase requisition log strengthens internal ‘spend’ authorization by aligning requests with the established approval limits for company personnel. When approval thresholds are enforced and documented in the log, management gains confidence that spending authority is being exercised appropriately. This reduces the likelihood of informal commitments or retroactive approvals that often lead to disputes and unauthorized spending.

You can learn more about the Authorization to Commit Funds or an Approval Limits in Purchasing table by following this link:

https://getyourpurchasingdocuments.com/product/approval-limits-template/

A Purchase Requisition Log Supports Audits and Review

A well-maintained log also serves as a defensible audit trail. Auditors frequently ask not only whether purchases were approved, but whether approvals occurred before commitments were made. The purchase requisition log provides time-stamped evidence that requests were reviewed, authorized, and documented in accordance with policy. This directly supports stronger financial controls and reinforces the organization’s broader internal controls framework.

Control and Steps – Procure-to-Pay Process

Within the broader procure-to-pay process, the purchase requisition log functions as the bridge between demand identification and transactional execution. Approved requisitions in the log can be matched to purchase orders, receipts, and invoices, ensuring alignment across procurement, receiving, and accounting. This traceability reduces reconciliation issues and supports three-way matching disciplines that protect against overbilling and processing errors.

Another important function of the purchase requisition log is its role in standardizing procurement documentation. When requisitions are logged consistently, organizations create a reliable dataset that can be analyzed over time. Procurement teams can review historical requests to identify recurring needs, justify strategic sourcing initiatives, or challenge unnecessary demand. Finance teams can use the same data to support budgeting, forecasting, and variance analysis.

For organizations still relying on email approvals or disconnected spreadsheets, the absence of a purchase requisition log often results in fragmented decision-making. Requests are approved without context, spending patterns go unnoticed, and accountability becomes difficult to enforce. In contrast, companies that implement a formal log gain a single source of truth that supports compliance without slowing down the business.

You can learn more about the Procure-to-Pay Process by following this link:

Add Link to the Blog “The Complete Procure-to-Pay-Process: A Step by Step Guide for Businesses

The Bottom Line – The Purchase Requisition Log Provides Organization and Control

Using a professionally designed purchase requisition log—such as those available on GetYourPurchasingDocuments.com—helps organizations implement this control quickly and correctly. These tools are designed to integrate with related documents, including the Purchase Requisition Form, approval limits tables, and purchase order templates, creating a structured and auditable workflow from request to payment. When paired with other resources on GetYourPurchasingDocuments.com, the log becomes part of a cohesive control environment rather than a standalone spreadsheet.

Ultimately, the purchase requisition log is not administrative overhead. It is a control mechanism that protects company assets, enforces policy, and improves decision-making. By providing visibility into what is being requested, who is approving it, and why, the log ensures that the procurement process remains disciplined, transparent, and aligned with organizational objectives.

In mature procurement organizations, the purchase requisition log is treated as a strategic control point. It enables better planning, reduces risk, and ensures that spending decisions are intentional rather than reactive. When implemented correctly, it becomes a quiet but powerful guardian of financial integrity.

Download a copy today and begin protecting your company’s profits.

$99.95

A Purchasing Record—often referred to operationally as a Buy Card—is one of the most overlooked tools in a disciplined procurement environment. When designed correctly, it gives organizations a controlled, auditable method for handling low-dollar purchases without weakening approval discipline, spend authorization, or internal controls.

For start-ups and small businesses, the Purchasing Record often begins as a manual solution. That’s not a flaw; it’s a bridge. Until a full procure-to-pay system or ERP is implemented, this document forms the backbone of purchasing documentation and establishes early financial controls that scale later.

The risk shows up when small purchases are treated as harmless. Employees bypass formal requests [i.e., Purchase Requisitions (PR)], invoices arrive without context, and accounting is left reconstructing who approved what—if anyone did. The Purchasing Record exists to close that gap and restore traceability before bad habits harden into policy violations.

You can see an example of a Purchase Requisition form by clicking on the link below.

https://getyourpurchasingdocuments.com/product/complete-purchase-requisition-form/

What Is a Purchasing Record and How a Buy Card Works

A Purchasing Record is a standardized document used to authorize and document purchases below a defined spend threshold where issuing a full purchase order would be inefficient. Internally, many organizations call this process a Buy Card, but clarity matters: a Buy Card is not a corporate credit card and not a workaround to procurement policy.

Instead, it is a structured spend authorization record that captures the minimum data required to support audit readiness and downstream reconciliation, including:

- Requestor and department

- Business justification

- Approved spending limits

- Authorized approver

- Supplier details

- Proof of receipt

This creates a defensible procurement audit trail while still allowing speed for operational needs. You can see an example of Approval Limits in Purchasing by visiting the link below.

https://getyourpurchasingdocuments.com/product/approval-limits-template/

Why Purchasing Records Strengthen Procurement Controls

Low-value purchases are where procurement controls quietly erode. Individually, these transactions seem insignificant. Collectively, they create exposure through unauthorized spending, budget leakage, and reconciliation delays.

A Purchasing Record enforces discipline by ensuring every transaction—regardless of size—has documented approval, alignment with approval limits, and clear records of authorized purchases. Without this structure, organizations invite non-PO spending to accumulate outside visibility until an invoice forces the issue.

This is where many companies lose control without realizing it.

Purchasing Record Alignment with Internal Controls and Compliance

From an internal control’s perspective, undocumented purchases are a flashing warning light. A Purchasing Record creates a repeatable, consistent process that aligns procurement activity with financial controls and audit expectations.

Auditors are not chasing perfection; they are looking for consistency and traceability. A documented Buy Card process demonstrates:

- Defined approval authority

- Segregation of duties

- Transaction traceability

- Evidence of spending control

This is especially important for organizations subject to SOX requirements, internal audits, or external financial reviews, where informal purchasing is often the first area challenged.

When to Use a Purchasing Record Instead of a Purchase Order

A Purchasing Record is intended for low-dollar, non-recurring, or time-sensitive purchases where issuing a purchase order would add friction without reducing risk. Typical use cases include maintenance items, operational supplies, emergency purchases, or one-time services.

It should never replace purchase requisitions or purchase orders for recurring, contractual, or high-risk spend. Instead, it functions as a controlled exception within the procure-to-pay process.

In some cases, such as ‘emergency purchases,’ company policy may still require after-the-fact purchase order issuance for system completeness. You can find an example of a Purchase Order Form by clicking on the link below.

https://getyourpurchasingdocuments.com/product/purchase-order-form/

How Purchasing Records Prevent Unauthorized and Non-PO Spend

Non-PO spend is not inherently dangerous. Undocumented non-PO spend is.

A Purchasing Record captures transactions that would otherwise surface only when an invoice arrives in accounts payable. By recording these purchases upfront, organizations gain visibility into buying patterns, enforce approval limits, reduce invoice disputes, and improve budget accuracy.

This is how informal spending becomes structured data instead of noise.

Purchasing Record Integration into the Procure-to-Pay Process

When properly implemented, the Purchasing Record is not a loophole—it is a formal step within the procure-to-pay workflow. It complements purchase requisitions for planned spend, purchase orders for sourced material, approval limits tables for governance, and receiving documentation for validation.

This alignment allows procurement to support operations without surrendering control, even when speed is required. You can find an article that discusses the Procure-to-Pay Process (P2P) at length by clicking on the link below.

https://getyourpurchasingdocuments.com/uncategorized/procure-to-pay-process/

Standardizing the Purchasing Record Template for Consistency

Standardization is where the real payoff happens. A uniform Purchasing Record template removes ambiguity, shortens training time, and ensures consistent application of internal purchasing controls across departments and locations.

Organizations that standardize this document experience fewer policy violations, faster approvals, cleaner audits, and better control of spending. The result is a procurement process that balances agility with accountability—and scales without chaos.

$49.95

A ‘Request for a Proposal’ (RFP) is a strategic business tool used to communicate the needs for product(s) or service(s) in an organized and structured fashion to Sellers (Suppliers).

An ‘RFP’ provides suppliers with project scope, deliverables, timelines, and much more.

The bottom line, a robust RFP process helps organize and streamline the procurement process when quoting projects and is very helpful when competing the company’s business among different sources.

If you need an illustration of a Request for Proposal (RFP) outline, you can download a copy using the link below.

$99.95

Why Every Company Should Use a Formal Request for Quotation (RFQ)

Companies waste an absurd amount of time and money chasing quotes that never match, don’t include the right details, or arrive in a form that’s impossible to compare. A formal Request for Quotation (RFQ) solves that problem. When you use a structured RFQ – like the ready-to-use version available on GetYourPurchasingDocuments.com (Link to RFQ template) – you bring discipline, accuracy, and speed to the quotation process. That directly translates into fewer mistakes, tighter cost control, and faster purchasing cycles.

A well-built RFQ is more than a form. It’s a safeguard. It forces clarity, ensures suppliers receive identical requirements, and creates a clean foundation for evaluating pricing, delivery, and commercial terms without chaos creeping into the process. Companies that rely on informal emails or ad-hoc supplier requests spend more time untangling confusion than making smart sourcing decisions.

A formal RFQ form creates a standardized channel for communication with suppliers, and that standardization is where the magic happens.

Reduced Errors by Providing Every Supplier with the Same Complete Requirements

Most pricing mistakes don’t come from “bad suppliers”—they come from incomplete requirements. When each supplier is reacting to slightly different descriptions, terms, or specifications, your quotes become apples-to-oranges. A structured RFQ eliminates that mismatch by giving every supplier the same set of details at the same time.

A sound RFQ document includes:

- Clear descriptions of the product or service

- Required quantities and units of measure

- Delivery requirements

- Technical drawings or supporting documents

- Terms, conditions, and quality expectations

- Instructions on how to submit pricing

A uniform RFQ also provides sourcing accuracy, i.e., once everyone is quoting from the same foundation, the errors vanish. No more suppliers quoting different part revisions. No more missing freight. No more “I didn’t realize you needed “testing” or “certification” surprises. The form acts as a filter that keeps assumptions out and accuracy in.

When your RFQ sets expectations upfront, the Purchasing and Procurement teams stop spending their days clarifying, correcting, and re-requesting quotes. Time saved is cost saved.

A Streamlined and Repeatable Request for Quotation Process

Speed in procurement comes from accuracy and repeatability. A formal Request for Quotation (RFQ) (Link to the RFQ Template) lets your organization run quotation cycles without reinventing the wheel each time. The RFQ gets the information needed from the Purchase Requisition Form (PR) (Link to Purchase Requisition form) Instead of crafting a new request or digging for old email chains, you simply drop the new requirement into the standard form and send them on to your suppliers. The RFQ and PR forms provide a method and workflow that keeps everything clean, organized, and compliant.

Using a standard RFQ also reduces internal confusion. Everyone in the company, from engineering to operations and finance, sees the same structure for every event. Over time, this consistency builds organizational muscle memory. People submit better requirements. Suppliers respond faster. The entire purchasing quotation process becomes smoother, quicker, and less prone to mistakes.

Companies that use a standard RFQ process routinely shave days or even weeks off their sourcing cycles because they’re no longer trapped in back-and-forth clarifications.

Effortless Integration into a Quote Summary Template for Cost Comparison

One of the biggest advantages of a formal RFQ is what happens after the quotes arrive. Because the RFQ forces suppliers to provide identical information, in a required format, all incoming quotes can be dropped into a quote comparison summary without gymnastics.

These two procurement documents, the RFQ form and a quote summary tab, provide the team with immediate clarity on:

- Total landed cost

- Differences in pricing by line item

- Cost drivers such as tooling, freight, or minimum order quantities

- Delivery times and lead-time risk

- Commercial deviations or exceptions

When all quotes align structurally, your quote summary becomes a quote evaluation tool instead of a reconstruction project. Executives love clean comparisons. Buyers love not having to “guess what the supplier meant.” And finance teams love the audit trail.

Your RFQ is the blueprint. The quote summary is the output. The more structured the input, the more intelligent—and defensible—the sourcing decision.

A Better, Faster, More Accurate Way to Source

A formal RFQ is one of the simplest ways to add professionalism, accuracy, and financial control to your purchasing process. If you want your procurement function to run like a production line—organized, consistent, and error-free—then using a structured RFQ is non-negotiable.

The RFQ template at GetYourPurchasingDocuments.com gives suppliers everything they need, eliminates the noise that causes misquotes, and sets up your team for clean comparison and smarter sourcing decisions. Download a copy today at https://GetYourPurchasingDocuments.com .

$199.95

Sales Invoice: The Final Control After the Sale of Goods or Services

An invoice is the formal document sent to a customer that converts completed work into enforceable revenue. Once goods ship or services are performed, this document becomes the official record that tells a customer exactly what they owe, why they owe it, and when payment is due. Without a complete Sales Invoice, even strong sales execution can unravel into delayed cash flow, disputes, and audit exposure.

In disciplined organizations, the Sales Invoice is not created as an afterthought. It is intentional post-sale documentation designed to close the loop between operations, sales, and finance. It confirms that contractual obligations were fulfilled and that the transaction is ready to move from operational completion into financial settlement.

Sales Invoice as a Critical Customer Invoice

From the customer’s perspective, the Sales Invoice is the definitive customer invoice. It must clearly describe what was delivered, in what quantity, at what price, and under which agreed terms. Ambiguity here creates friction inside the customer’s Accounts Payable function, where invoices are reviewed, validated, and approved for payment.

This is especially true for an invoice for goods and services tied to a formal Purchase Order. Customers expect the invoice to mirror the structure and content of the PO they issued. When pricing, part numbers, service descriptions, or freight terms do not align, approvals stall and disputes begin.

You can find an example of a Purchase Order Form by following the link below.

https://getyourpurchasingdocuments.com/product/purchase-order-form/

That alignment is why many organizations deliberately link their Sales Invoice back to standardized Purchase Order Forms and delivery confirmation records, such as a Goods Received Note, both of which are foundational documents within the procure-to-pay and order-to-cash ecosystems discussed across GetYourPurchasingDocuments.com and mscsgrp.com.

Sales Invoice and the Invoicing Process

The invoicing process is where operational performance meets financial reality. A complete Sales Invoice confirms that goods shipped, or services rendered meet contractual terms and are ready to be billed. This step must be controlled, repeatable, and auditable.

Within Accounting, the invoice becomes the primary Accounts Receivable invoice used to track outstanding balances, manage collections, and forecast cash flow. Errors at this stage ripple outward—impacting working capital, customer relationships, and financial reporting.

This is why experienced teams treat the Sales Invoice as a controlled billing document, subject to review and validation before release. Controls that verify quantities, pricing, approvals, and delivery references reduce downstream rework and protect revenue.

Sales Invoice Payment Terms and Cash Discipline

Clear invoice payment terms are one of the most overlooked levers in cash management. The invoice is the mechanism that enforces those terms. Whether the agreement is Net 30, Net 45, milestone-based billing, or partial retainer, the invoice must state those conditions unambiguously.

When payment terms are missing or unclear, customers default to their internal standards—usually slower. This is not a negotiation tactic; it is administrative gravity. Strong invoicing discipline keeps payment expectations visible and defensible.

Sales Invoice Accuracy and Invoice Reconciliation

Most invoice disputes stem from preventable issues. Poor invoice accuracy—incorrect pricing, missing references, or vague descriptions—forces customers to stop payment until discrepancies are resolved. Each hold extends days sales outstanding and consumes internal resources.

Effective invoice reconciliation depends on traceability. A Sales Invoice that references the customer’s Purchase Order, delivery confirmation, and agreed pricing allows both parties to resolve questions quickly. This mirrors the same control logic used in three-way matching on the procurement side of the business.

Organizations that standardize their Sales Invoice formats see fewer disputes, faster approvals, and cleaner audit trails.

Sales Invoice and Revenue Recognition Documentation

From a financial reporting perspective, the Sales Invoice plays a central role in revenue recognition documentation. It establishes that revenue is earned, measurable, and supported by completed performance. Auditors expect invoices to be tied back to contracts, delivery records, and approval authority.

If you are looking for a Goods Received Note or Receiving Log, you can find an example by clicking on the link below.

https://getyourpurchasingdocuments.com/product/goods-received-note/

Revenue booked without a verifiable contract and invoice documentation increases the risk of reclassification or audit findings. For this reason, mature organizations align their invoicing controls with broader approval limits and authorization frameworks—the same discipline applied to procurement spend controls.

Another important tool for protecting your company is the use of Purchase Order Terms and Conditions with your purchase order form. You can see an example of these Ts and Cs by following this link:

https://getyourpurchasingdocuments.com/product/purchase-order-ts-and-cs/

Why a Complete Sales Invoice Is Non-Negotiable

An invoice is not administrative overhead. It is the final control that protects revenue after the sale is complete. Companies that underinvest in invoicing discipline pay for it through delayed payments, strained customer relationships, and unnecessary financial risk.

By treating the Sales Invoice with the same rigor applied to Purchase Orders, Goods Received Notes, and approval workflows, organizations create a clean, auditable bridge between operations and cash.

You can find a great example of a Sales Invoice by following the link below.

https://getyourpurchasingdocuments.com/product/sales-invoice/

To learn more about invoicing, you can follow the link below.

Why Is Invoicing Software Essential for Your Business?

For more information about Procurement, Supply Chain Management and Operations please visit https://GetYourPurchasingDocuments.com .

$399.95

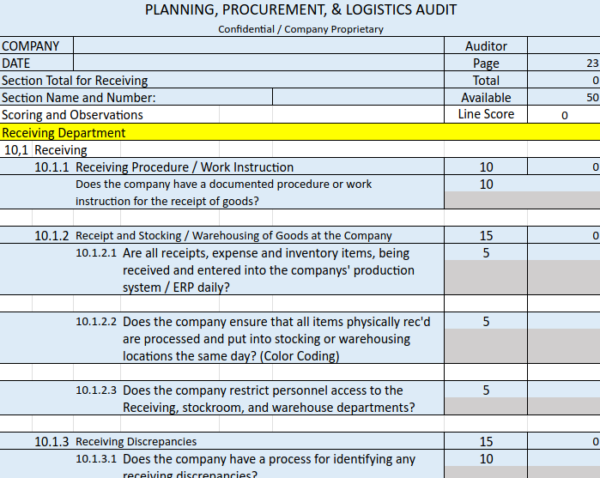

Supplier Operations Audit: Why Planning, Procurement, and Logistics Matter

A Supplier Operations Audit is one of the most effective risk-reduction tools a company can deploy before awarding spend to a new supplier. While price, quality certifications, and references matter, they rarely tell the full story. The real risks live inside a supplier’s planning discipline, procurement controls, and logistics execution. A structured audit brings those risks into the light—before they disrupt production, inventory, or customer commitments.